SaaS Feedback: Everything You Need to Know About Collecting & Using It

By Dayana Mayfield

Last updated on Tue Aug 05 2025

Collecting SaaS feedback is essential towards building a sticky product.

The global SaaS market is projected to hit $390 billion in revenue in 2025, up from $250 billion just last year. That explosive growth is no accident—businesses across the world are doubling down on SaaS tools because of their flexibility, scalability, and continuous improvement. Even a small slice of that market can mean a meaningful, profitable business for you.

We have two profitable, bootstrapped SaaS business already (Curator and Frill) and are currently building our third SaaS company (Flook).

We consider ourselves obsessed with collecting customer feedback. But we want it to be easy and painless for our product team and for our customers.

In this post, learn the different types of feedback and how to organize all of it in one place that helps you engage your users and build smarter.

Why collecting SaaS feedback is non-negotiable today

As the SaaS industry matures and competition increases across every category, product teams are under more pressure than ever to evolve quickly and meet rising user expectations. It's no longer enough to rely on intuition or internal roadmaps. Modern SaaS teams need real-time, user-driven insights to stay relevant, reduce churn, and continuously improve. Feedback isn’t just a “nice-to-have”—it’s a survival tactic.

The SaaS explosion and shifting user expectations

SaaS usage has skyrocketed. Teams today use dozens of tools—each solving very specific problems. That means users expect more from each app: tighter UX, faster iteration, better integrations, and more transparency. The bar is simply higher. If your product doesn't improve continuously (and visibly), users won’t hesitate to switch to a competitor with a more user-driven roadmap.

Feedback plays a role from MVP to PMF and beyond

No matter your stage—early MVP, scaling product, or mature platform—feedback plays a different but critical role. In the MVP phase, it helps validate problems and prioritize features. Once you hit product-market fit, it helps refine your experience and surface usability gaps. And for mature products, feedback becomes key to staying aligned with evolving user needs and staying ahead of churn risks.

Ignoring the feedback loop is where most SaaS products fail

Too many teams focus on shipping fast, but not necessarily shipping right. When you don’t close the loop with users or ignore patterns in feedback, you risk building the wrong things—and losing trust. SaaS companies that treat feedback as a core part of their product development process are the ones that adapt fastest and build the stickiest products.

Types of SaaS feedback

86% of companies expect at least 80 percent of their software needs to be met by SaaS after 2022. More companies are buying more SaaS products than ever before.

To capture more of the market and keep your customers happy, you need to listen to feedback.

These are the main types of feedback that SaaS companies get from their target customers and actual users.

1. Pre-prototyping feedback

Before building a SaaS product, you need to understand what users are looking for. It’s smart to talk with target customers before you even prototype your product

How to collect this feedback: There are many different ways to collect this sort of feedback. You can pay a market research company like Centiment or SurveyMonkey. You can cold call and cold email target users and ask for a quick interview. Or you can ask friends and colleagues to introduce you to the right contacts to interview.

2. Low fidelity prototype feedback

After creating a low fidelity prototype (such as a PDF file or a drawing on a whiteboard), you need to get feedback on the dashboard and features.

How to collect this feedback: For this type of feedback, you shouldn’t use a market research company but should reach out directly to target users. You can do this on social media, with cold outbound email, or by requesting introductions from people you know. If you use tools like a DMARC checker, you can even ensure your email deliverability. Your low fidelity prototype most likely won’t be self explanatory, so ask each contact to hop on a 10-minute call to get their feedback. What you’re looking for is data on what users actually want you to build and what are the most critical features for your MVP.

3. High fidelity prototype feedback

You can create a realistic prototype using Adobe XD, Invision, or Miro. Then, you’ll want to collect feedback on the high fidelity prototype before turning that prototype into the backlog required to build your MVP.

How to collect this feedback: Similar to the points above on low fidelity prototypes, you need to build direct relationships with target users. This type of prototype should be a bit more self explanatory, so you could collect feedback via email or survey, but quick screensharing phone calls or in-person user testing will be more ideal.

4. Beta user feedback

After you’ve created an MVP based on your validated prototype, the next step is getting beta users. You’ll want to find out what they think of your product, what features they want to see, and how well it addresses their problems.

How to collect this feedback: If you’re giving away free lifetime access to your beta users, they should reciprocate by giving you suggestions and helping with QA. You could make a private Slack channel or Facebook group for your beta users, or set up a customer feedback portal with Frill so everyone can add ideas at any time.

5. New product or feature launch feedback

When you launch any new product or feature, you need to discover what users think about the overal user experience, the efficacy of the functionality, and whether or not it met their expectations and goals.

How to collect this feedback: When you launch something new, take the opportunity to point users in the direction of your feedback portal. This way they learn where to submit feedback now and in the future. You could promote your feedback portal on your website with an announcement bar and in your email newsletter.

Sign up to Frill

Ready to automate your customer feedback? Or perhaps create a public Roadmap? Get started with Frill’s free plan.

Get started with Frill6. Existing feature feedback

This could be suggestions, bug discoveries, functionality improvements, design ideas, etc.

How to collect this feedback: Feedback will often come from all angles. It can come from your customer community, customer support chats, replies to your marketing emails, and other channels. It’s smart to train customers where to give you feedback and to be proactive about how you collect it. A feedback portal or widget where users can submit ideas at any time is your best bet.

7. Desired feature feedback

These are suggestions for new features that your users want you to add to your product, or features that need UX or functionality improvements.

How to collect this feedback: Your life will be a whole lot easier if you start training users where to leave this kind of feedback. Create a dedicated platform for collecting feature ideas and link to it from multiple sources (your website, inside of your app, onboarding emails, etc.)

8. Sales process feedback

Your sales process will largely depend on the annual cost of your software. Software below $500 per year is typically sold without demos, but software over around $1000 per year can be sold with direct credit card payments and demos. But these standards don’t mean there’s not room for improvement. You can get data on every part of your funnel and sales cycle.

How to collect this feedback: Ask users for feedback on your website. For example, you could have a feedback widget for people who have been on your pricing page for longer than 60 seconds. The chat pop-up could ask if they have any questions on the pricing. For inside sales, your account executives could regularly ask for feedback from leads and closed accounts during the end of the sales cycle.

9. Feedback given during customer churn

Churn feedback refers to the insights you collect from users right as they cancel their subscription or fail to renew. While it’s easy to write off churned users as lost causes, this group often provides some of the most honest, actionable feedback. These users had a reason for signing up—and a reason for leaving. Understanding that gap can be a game-changer for your retention strategy.

How to collect this feedback: To make the most of churn feedback, you need to make it automatic and effortless.

Ask “What went wrong?” automatically: Embed a short, open-ended feedback form into your cancellation flow. The question should be simple but open enough to gather real context. For example: “What’s the main reason you’re leaving?” or “Is there anything we could have done differently?”

Use lightweight tools and good timing: Follow-up emails sent 1–3 days after cancellation can also work well. Tools like Frill, Refiner, or Survicate can trigger contextual surveys inside your app or send quick exit polls by email. Just make sure the request feels personal and low-pressure.

Turn churn into product gold: One Frill customer collected a series of churn responses mentioning confusion around pricing tiers. They turned that feedback into a revamped pricing page with clearer comparisons—and saw an immediate lift in activation rates. That’s the power of listening, even when the user is walking out the door.

The best tools for collecting SaaS feedback

Try these top tools for collecting, organizing, and prioritizing feedback on your SaaS product.

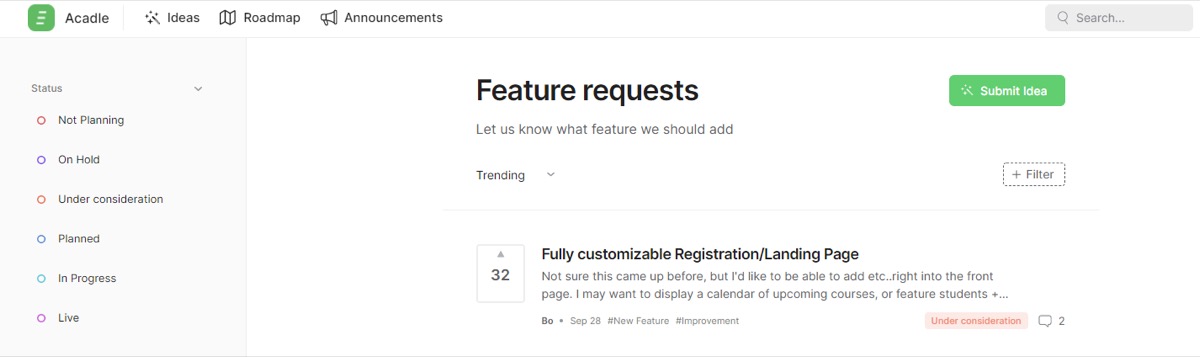

1. Frill

Frill is the go-to feedback tool for SaaS companies looking for a highly sophisticated yet simple-to-use solution. The platform helps organizations understand customer needs and preferences by collecting user feedback from websites and apps via widgets and Idea portals.

Besides feedback collection, Frill offers smart tools for managing, analyzing, and understanding feedback. Whether you are a small, medium, or large SaaS company, you won’t have trouble finding a Frill plan that fits your budget.

Features:

Web platform and embeddable widget

Language translation options

Unlimited team members and tracked users

Roadmap

Freemium plan

Customizable themes

Automatic status updates

Surveys

Pricing:

Frill starts at $25/month for 50 ideas and one survey. The $49/month Business plan includes unlimited ideas and 3 surveys. Growth at $149/month adds privacy, surveys, and white labeling. Enterprise starts at $349/month with SOC2, audit logs, and dedicated hosting. 14-day free trial.

2. Refiner

Refiner is an excellent tool for collecting quantitative user feedback. You can use the platform to learn about customer satisfaction and how to improve your services via micro-surveys or in-product surveys. You can tailor surveys to meet your unique needs and get the specific answers you want. Refiner also allows you to automate what follows after a user completes a feedback survey.

Features:

Multilingual surveys

Unlimited survey responses

NPS, CSAT, CES, and PMF templates

In-app surveys for mobile and websites

Email surveys

Slack and email notifications

Pricing:

Refiner starts at $99/month (Essentials) with unlimited survey responses, all survey types, segmentation, and basic integrations. The Growth plan is $239/month, adding event tracking, translations, and advanced integrations. Enterprise plans are custom-priced with white-labeling, SSO, and dedicated support. 30-day free trial included.

3. Usersnap

With Usersnap, you can gather quantitative and qualitative user feedback through micro-surveys and feature request boards. The platform also provides insights into customer experience through its in-app screen capture feature. The many feedback collection tools provided by Usersnap simplify understanding customer needs so SaaS companies can keep improving their products and services.

Features:

In-app screen capturing

Micro-surveys

Feature request boards

Customizable widgets

Public requests upvote board

Pricing:

Usersnap starts at $39/month for 2 projects and 5 seats. The Growth plan is $89/month, and Professional is $159/month with more seats, targeting, and user identification. Premium starts at $319/month. All plans include surveys, screen capture, and feedback widgets. First 20 feedback items are free.

4. ProProfs Survey Maker

ProProfs Survey Maker offers several options for collecting quantitative feedback to gain clear insights into what users like and dislike about your product. For example, in-app surveys allow users to give feedback without leaving your SaaS tool. Also, the platform provides feedback tools for collecting user suggestions on how to improve your product and services.

Features:

Online questionnaire software

NPS survey software

Scored survey software

Market research software

Email survey software

Zendesk, Salesforce, and Mailchimp integration

Online form builder

Pricing:

ProProfs offers a free plan with up to 50 survey responses and 500 email sends, ideal for startups. The Business plan supports higher response volumes and includes advanced features like NPS, branding, skip logic, and multi-language surveys. White-labeling is available for $300/year as an add-on.

5. Survicate

With Survicate, you can automate surveys and continuously collect customer insights in real time. SaaS companies can get all the user insights they need with Survicate tools like in-product surveys, mobile app surveys, and website surveys. You can avoid the hassle of building surveys from scratch since Survicate offers hundreds of survey templates that you can modify to meet your needs.

Features:

Slack, HubSpot, and Klaviyo integration

Multilingual surveys

Unlimited free users

Custom survey design

Pricing:

Survicate offers a Free plan with 25 monthly responses. The Starter plan is $79/month with 100 responses and custom branding. The Growth plan starts at $49/month (billed annually) with unlimited surveys, multilingual support, advanced targeting, and AI insights. All plans include GDPR compliance, integrations, and human support.

6. Typeform

Typeform allows you to create surveys and share or embed them anywhere on your app or website. You don’t need coding skills to make the most of the tool, and you can share surveys or questionnaires via email or social media.

Besides traditional surveys, Typeform offers Videoask – a tool that allows you to record a video where you ask survey questions and share your link. Customers who receive the video can respond with their own video, offering a fun way to provide customer feedback.

Features:

Hundreds of customizable templates

Google Analytics, Mailchimp, and Airtable integration

Videoask

Unlimited typeforms and questions

Webhooks

Pricing:

Typeform’s Basic plan is $25/month with 100 responses and 1 user. Plus is $50/month with 1,000 responses, branding removal, and 3 users. Business is $83/month, offering 10,000 responses, advanced analytics, and 5 users. Enterprise plans are custom-priced with SSO, VIP support, and compliance options.

7. UserVoice

UserVoice equips SaaS teams to understand what customers want. With the platform, capturing, tracking, and managing user feedback becomes effortless, and you can scale the platform to manage as much feedback as you need. Another advantage of the platform is it allows you to gather feedback from multiple sources and manage all the data in one convenient location.

Features:

Built-in reports and metrics

Web portal and in-app widget

Public status updates

Unlimited micro-surveys

Pricing:

UserVoice starts at $899/month (Pro) for up to 1,000 users and includes a feedback portal, in-app widget, integrations, and SSO. The Team plan is $1,199/month for 3,000 users with advanced internal tools. Premium is $1,349/month for 5,000 users. Enterprise plans are custom and include AI insights and advanced security.

8. CustomerSure

You can use CustomerSure to collect customer feedback and share your insights with teams across your company. The software also provides tools for making the most of insights to understand and implement the product and service improvements your customers want.

Features:

Custom email, SMS, web, and app surveys

Multilingual

Real-time alerts

Personalized reports

Pricing:

CustomerSure starts at £999/month (CX Starter) for lower volumes. CX Pro ranges from £1,999–£4,499/month, ideal for multi-team VoC programs. CX Platinum is custom-priced for enterprise needs. All plans include onboarding, platform setup, and access to expert support. VAT excluded; annual or flexible billing available.

9. Userpilot

SaaS teams use Userpilot to collect qualitative user feedback through in-app micro-surveys. You can customize surveys to match your needs and preferences and use insights from the surveys to optimize your product experience. Another reason to love Userpilot is the option to analyze user feedback at scale.

Features:

Net Promoter Score (NPS)

Integrations

Growth insights

Live chat support

Pricing:

Userpilot starts at $299/month (paid annually) for up to 2,000 monthly active users, including NPS surveys, user segmentation, and in-app engagement. The Growth plan begins at $799/month with advanced analytics, custom MAUs, and additional features. Enterprise pricing is custom, offering SAML SSO, SLAs, and full support.

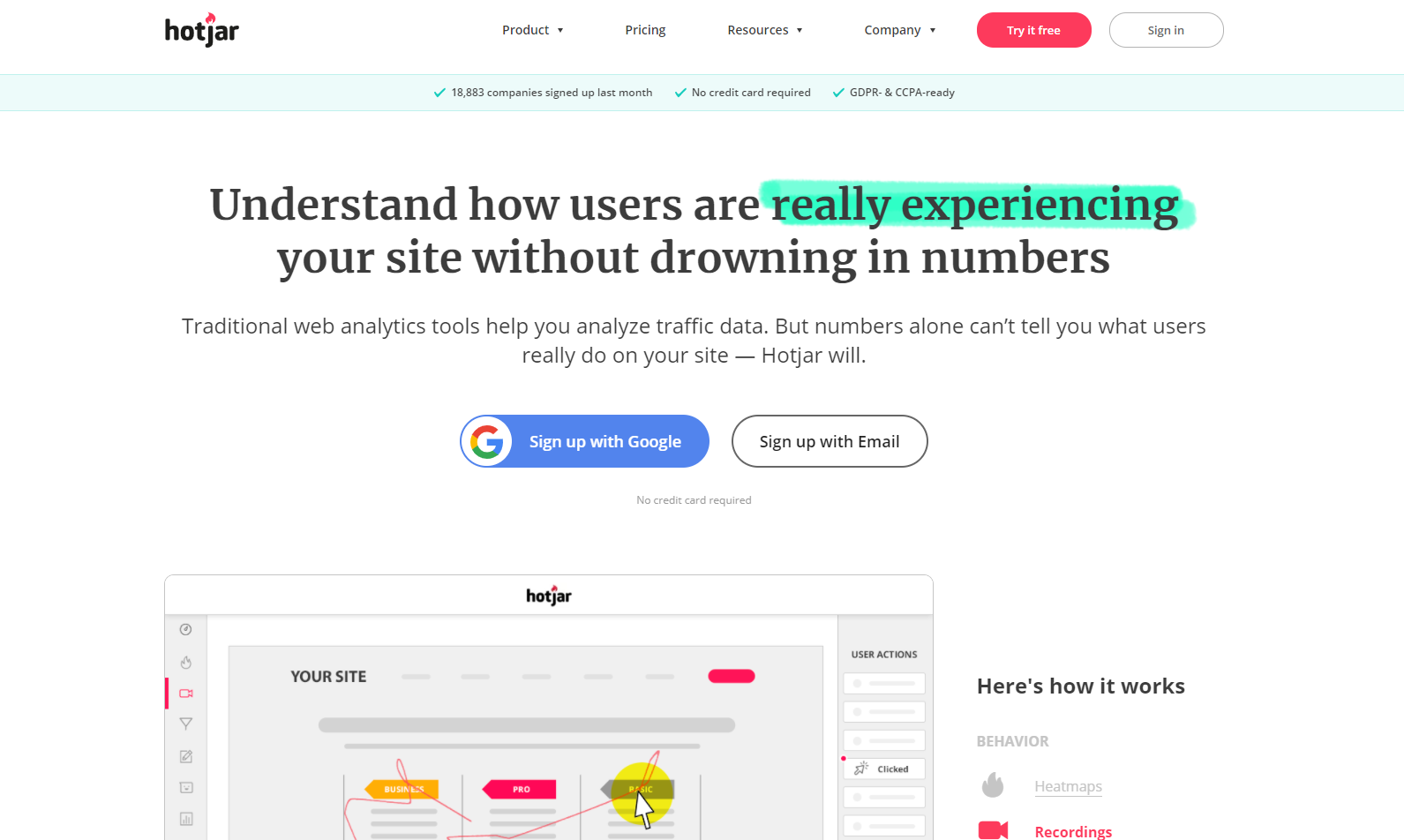

10. Hotjar

Get feedback and respond in real-time with Hotjar’s live feedback and heatmap. The feature allows you to understand how users interact with your website and identify and rectify shortcomings before they lead to customer churn. Users can also submit recordings of issues experienced while using your platform.

Features:

Heatmaps

Recordings

Surveys

Feedback in 40+ languages

Forever feedback storage

Pricing:

Hotjar's Observe plan starts free with 35 daily sessions. Plus is $32/month, and Business begins at $80/month for 500 sessions. Scale is $171/month, adding funnels, trends, and SSO. Additional products: Ask (surveys) from $64/month, and Engage (user interviews) from $440/year. Bundle discounts available.

The ultimate feedback tech stack for SaaS teams

Choosing the right tools for collecting feedback isn’t just about picking the most powerful platforms—it’s about assembling a stack that complements your company’s size, goals, and workflow. Below are three curated SaaS feedback stacks, each tailored for different growth stages.

Lightweight stack for early stage startups

Recommended tools:

Frill

Hotjar

For early-stage teams, simplicity and speed are key. Frill provides everything you need to collect user ideas, run surveys (like NPS and CSAT), and share product roadmaps—all in one focused interface. Pair it with Hotjar to capture real user behavior via heatmaps and session recordings. Together, these tools help founders and product teams validate ideas, surface usability issues, and prioritize feedback without overwhelming complexity or cost.

Growth stack for scaling SaaS products

Recommended tools:

Frill

Refiner

Userpilot

As your product matures, feedback needs become more nuanced. Frill anchors the stack with roadmap transparency and structured idea collection. Refiner complements it with customizable micro-surveys and powerful user segmentation to track sentiment and spot trends. Userpilot adds in-app engagement and contextual feedback options, like triggered surveys and user behavior tracking. This stack supports growth teams with deeper insights while maintaining user-centric product development.

Enterprise-ready stack for cross-team collaboration

Recommended tools:

UserVoice

CustomerSure

Hotjar

Larger organizations need centralized, scalable feedback operations. UserVoice enables structured idea management across multiple teams and products. CustomerSure supports enterprise-wide VoC programs with detailed reports, multi-channel surveys, and real-time alerts. Hotjar enhances both by visualizing user behavior, revealing friction points that surveys alone can’t capture. This stack empowers cross-functional teams to act on insights collaboratively and drive customer-centric improvements.

How to organize SaaS feedback

While there are many different types of SaaS feedback, the most important type for any product-led team is feedback on your current features and UX.

It’s smart to have one central place to collect all of this feedback.

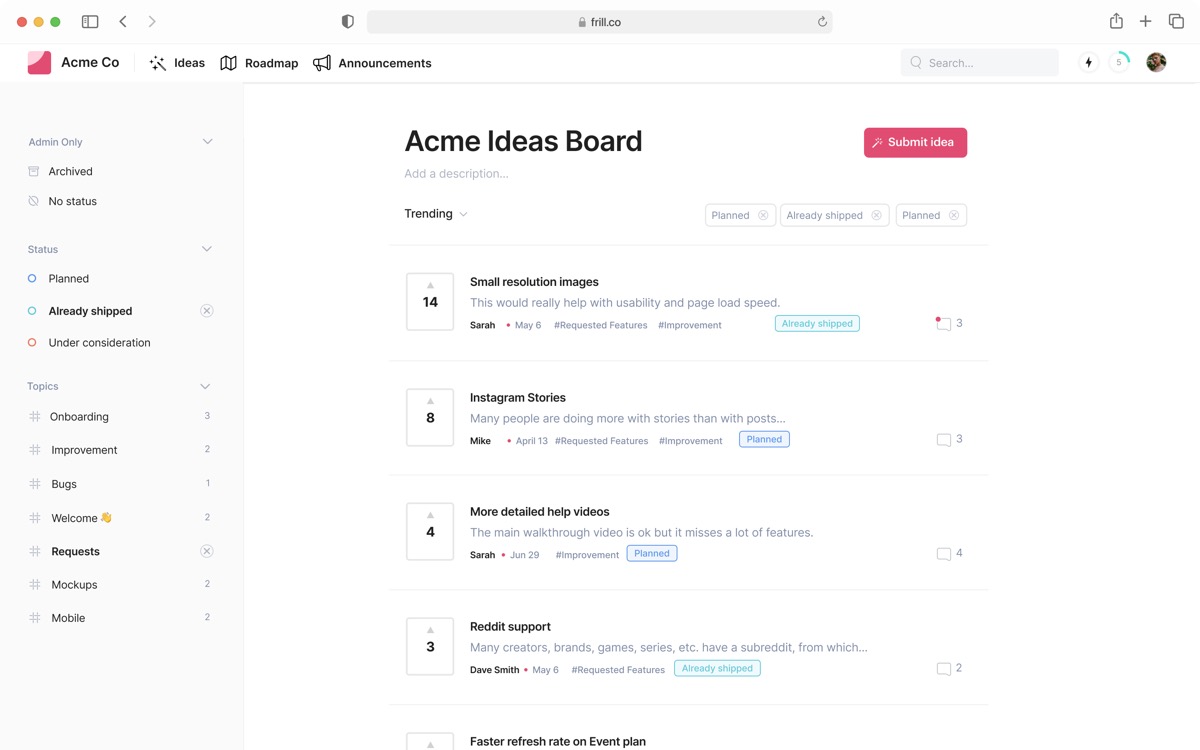

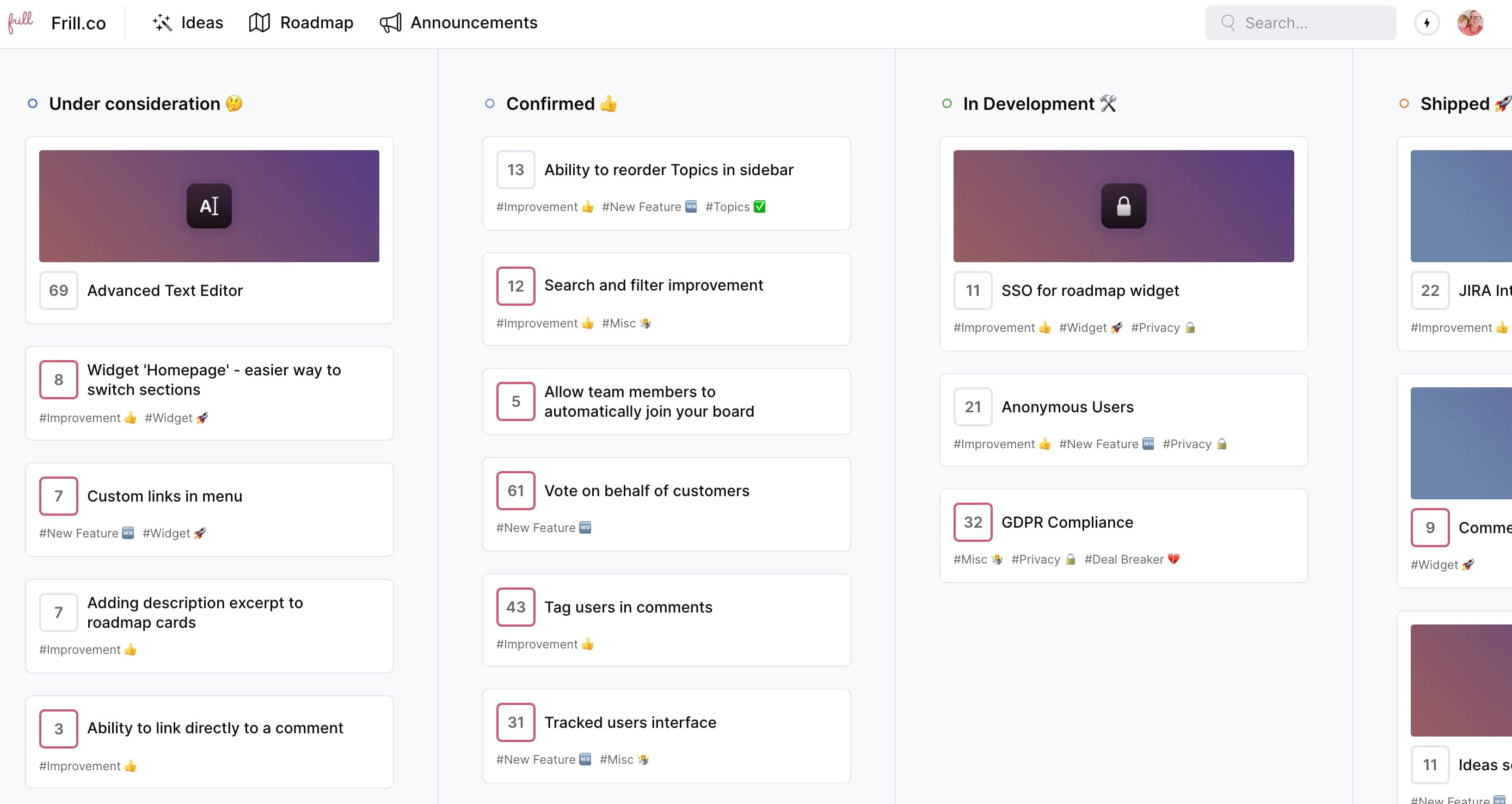

Here’s what Frill’s own Frill board looks like:

We have four different labels that organize the user’s feedback.

Under consideration

Confirmed

In development

Shipped

With Frill, you can create as many columns as you want, and manually assign the right label after a user has submitted an idea.

There are a lot of benefits to having a dedicated feedback board:

Consolidate feedback in one place

Gradually train users where to leave feedback

Ability to engage and communicate with users for more context

The user engagement piece is essential, as this can foster even more loyalty to your product.

How to engage users and get feedback 24/7

People are busy, especially B2B software users. It’s important to understand that getting feedback from your users is like getting a free gift. Sure, it could benefit them if you build it, but it’s really a favor that they are giving you.

It’s so important to be encouraging and grateful.

Here are some best practices when it comes to requesting and encouraging SaaS feedback.

Close the feedback loop

Don’t make it difficult for users to leave feedback. A tight feedback loop is simple and easy.

Here’s how:

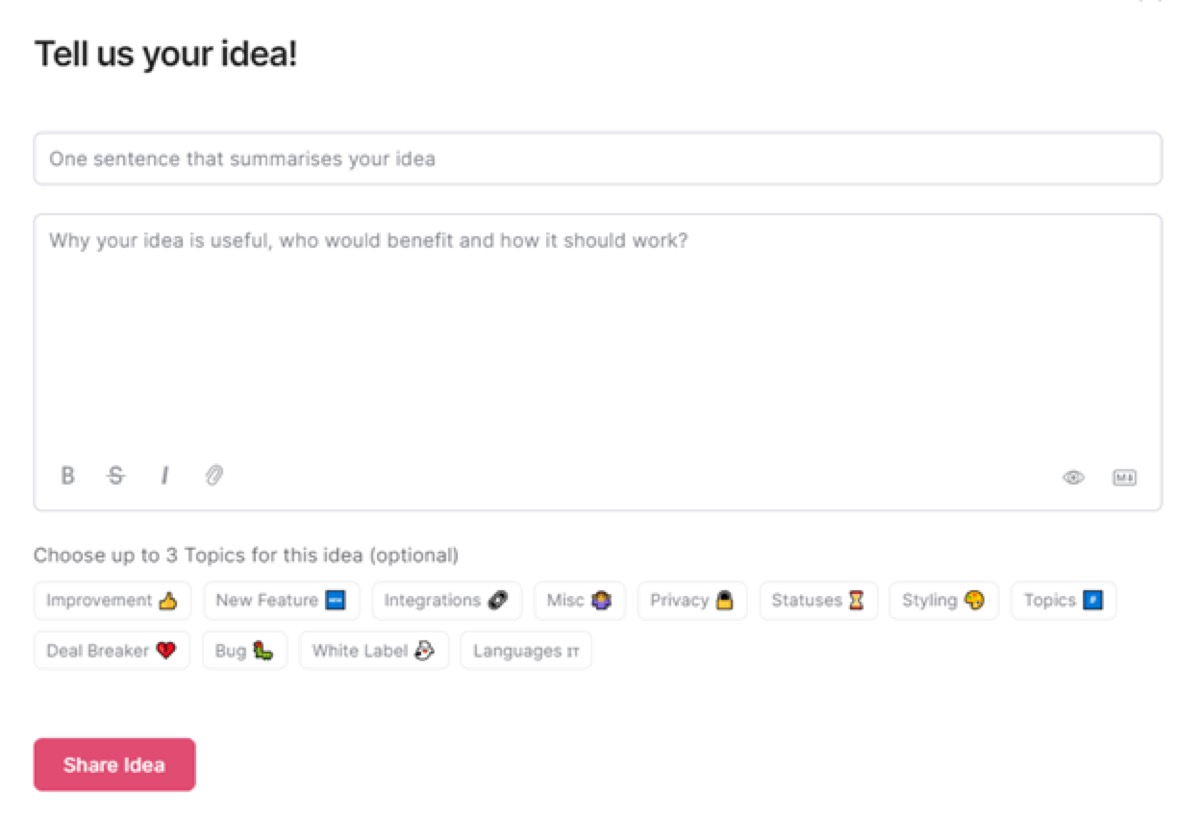

Use one consolidated portal for SaaS feedback

Make sure that portal has simple UX

Don’t ask too many questions or attempt to collect a lot of data points

Leave the suggestion collection open-ended

Build additional feedback loops into your onboarding and lifecycle emails

Asking for feedback early on isn't enough. You need to ask for feedback often, and build it into the customer experience.

Ask the right questions at the right time: Email is still one of the most effective (and overlooked) channels for collecting product feedback. With lifecycle emails, you can time your questions to key moments—like right after onboarding, a feature activation, or a milestone. Keep it short and specific: “What’s the one thing we could improve?” works better than a broad “Got feedback?”

Use Frill's Idea Polls to trigger mid-journey feedback: With Frill’s Idea Polls, you can embed feedback collection directly into your user journey. Tie polls to events like completing a task or hitting a roadblock. These quick, low-friction touchpoints let users vote or suggest ideas without context switching.

Segment feedback requests based on plan or persona: Not all users want—or need—to answer the same questions. Tailor your asks based on account type, usage level, or role. For example, enterprise admins might get roadmap feedback requests, while new users might get onboarding-specific surveys. This keeps your feedback relevant and engagement high.

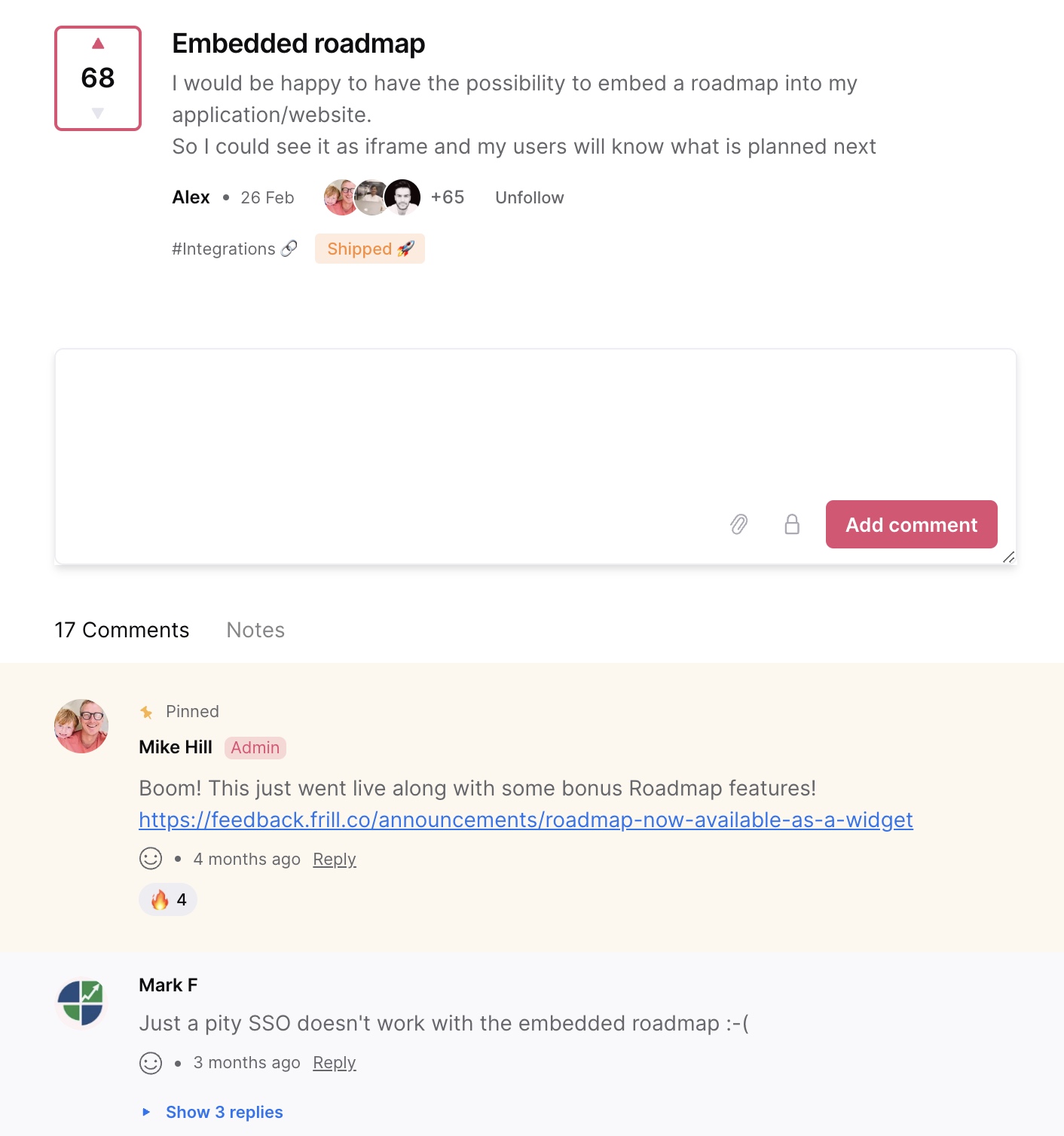

Communicate with users whether or not you will use their suggestions

You should respond to every user whether or not you plan to implement their feedback. Whatever feedback collection tool you use should make it easy to communicate back and forth with your users.

If you’ve implemented SSO, they can offer feedback with the same login they use for your SaaS platform.

Other users should also be able to hop in on the conversation to offer their take.

Reward users who regularly provide constructive feedback

Everyone knows what a power user is. But what about a power critic?

If you’ve got users who are always offering suggestions, you should thank them for their time. While you might not be willing to give your software subscription away for free, you can find other ways to show your appreciation. You could send them an Amazon gift card, offer some embroidered shirts and other swag, or if it makes sense, an in-depth customer success or strategy session.

On the other hand, if you're struggling to get feedback from users, you could consider offering incentives. State that it's a one-time deal to celebrate the launch of your feedback portal. Offer a $15 gift card to Amazon or some swag to the first 20 people who submit an idea or feature request.

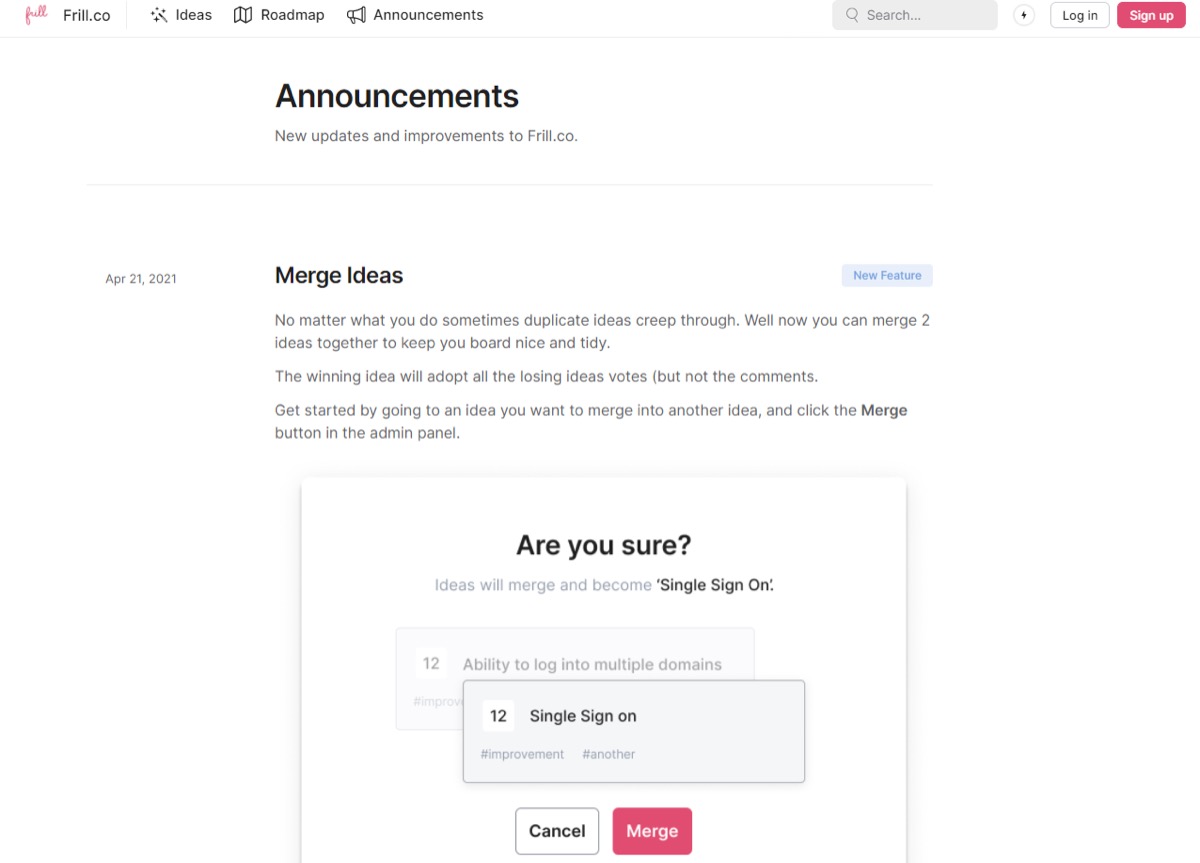

Set up an announcements page to showcase your listening and innovation

Users want to rely on software that is going to get better with time, not worse. (Those are the only two options, really.)

Showcase your business as one that cares about users and wants to continually innovate.

You can do this by showing your announcements in your feedback portal and on your website.

Create a new announcement for any update—big or small—that you want users to know about.

Don’t forget internal feedback from support & sales teams

Customer feedback is critical, but so is what your internal teams are hearing every day. Sales and support teams are often the first to spot recurring pain points, feature requests, or messaging confusion. Yet their insights are rarely collected in a structured way.

Start by creating a simple process for surfacing and centralizing internal feedback. That could be a dedicated internal board in Frill or a shared Slack channel where team members can drop common themes. Set expectations that reps and agents should log feedback weekly, not just when something seems urgent.

To make this scalable, integrate Frill with tools like Intercom or HelpScout. You can automatically tag conversations that include keywords like "feature request" or "bug" and send them directly into your feedback board. This removes manual friction and ensures no valuable input is lost.

It’s also important to recognize how internal feedback differs from user feedback. Your team is often synthesizing what they hear across many conversations. Their suggestions tend to be more strategic or highlight gaps in your UX and onboarding. Use this internal lens to balance quantitative customer data with high-context frontline insights. Both are essential for building a product that sells and supports itself.

Metrics That Matter: Measuring Feedback Quality and Volume

Collecting feedback is easy—what’s harder is measuring whether it’s useful, actionable, and aligned with product goals. For SaaS teams, especially product managers and marketers, tracking the right metrics helps ensure feedback is driving decisions rather than creating noise. You don’t need to over-engineer it, but a few simple ratios and velocity checks can keep your process sharp.

Here are a few practical metrics to track:

Feedback-to-feature ratio: Measure how many pieces of feedback it typically takes to justify building a feature. This helps avoid overreacting to one-off requests and sets a data-informed bar for prioritization.

Feedback velocity: Track how much feedback is coming in over time. A spike might signal a usability issue or the success of a new onboarding flow. A drop might mean you're not asking at the right touchpoints.

Feedback source diversity: Are you only hearing from power users or one segment? Track which channels and personas are submitting ideas so you can spot blind spots.

Priority score (Frill’s Priority Matrix): Frill’s built-in Priority Matrix allows you to rank ideas by impact, effort, and importance. This helps cut through high-volume feedback and focus on what matters most.

Ultimately, tracking feedback quality and volume isn’t just about metrics—it’s about aligning product development with real customer needs. The goal isn’t to respond to every idea, but to consistently recognize the patterns that lead to better product outcomes.

How to build a culture of feedback across your team

The best SaaS products aren’t just shaped by product managers—they’re shaped by entire teams that understand the value of user feedback. Creating a culture where feedback is seen as fuel rather than noise can lead to faster iteration, more impactful features, and a stronger connection between your product and its users.

Train teams to see feedback as product fuel

Start by changing how feedback is talked about internally. Rather than viewing it as “support tickets” or “user complaints,” frame feedback as signals from real people trying to succeed with your product. Train every team—from marketing to engineering—to recognize valuable feedback and know how to share it. Make feedback part of onboarding, and ensure everyone knows where to log insights, whether it’s in Frill, Slack, or your CRM.

Get leadership buy-in to prioritize feedback

Cultural change starts at the top. If leadership treats feedback as a nice-to-have instead of a strategic input, it’ll never take root. Make the case with metrics: show how feedback led to a key feature release or reduced churn. When executives publicly reference customer feedback in roadmap discussions or all-hands meetings, it signals that feedback matters.

Share wins company-wide when feedback drives success

Every time a piece of feedback leads to a meaningful improvement, celebrate it. Give shoutouts to the customer who sparked the idea, the rep who logged it, and the team that shipped the fix. Use changelogs, internal newsletters, or product updates to close the loop internally, not just with users.

When feedback becomes part of everyday thinking—not just a quarterly review exercise—you create a culture that listens, adapts, and grows.

While there are many types of SaaS feedback, none are so critical as the feedback you collect about your product. After all, without this customer feedback, you wouldn’t be able to build something that people want to pay for and you could lose out to competitors who are more in touch with the end user experience.

Frill is a customer feedback, roadmap, and announcement tool for SaaS. Check out our affordable plans.